Money matters have a great impact on relationships

It may be the most unromantic theme there is, but there is no question to the following fact - money matters have a profound impact on romantic relationships. For a couple with different views on financial management, it can easily lead to escalating conflicts, or a dynamic where both become increasingly entrenched in their respective roles - the saver and the spender. To nurture a healthy and harmonious partnership, it is crucial to address these divergent perspectives with warmth, understanding, and effective communication.

Understanding the impact of money matters in relationships

Differences in financial attitudes can create significant friction within couples, affecting trust, intimacy, and future plans. Disagreements about spending habits, saving strategies, or financial priorities can strain the emotional connection between partners and undermine the overall well-being of the relationship.

Causes of divergent financial perspectives

1. Upbringing and personal experiences

Individuals bring unique financial backgrounds into their relationships, shaped by their upbringing and past experiences. One partner may have grown up in a household that emphasized frugality and saving, while the other may have had more financial freedom. These contrasting backgrounds can lead to conflicting viewpoints and challenges in finding common ground.

2. Personal values and goals

Each partner may possess different values and goals when it comes to money. One might prioritize financial security and long-term planning, while the other might lean toward enjoying the present and pursuing personal fulfillment. These divergent perspectives can create tension as each partner seeks to honor their values and aspirations.

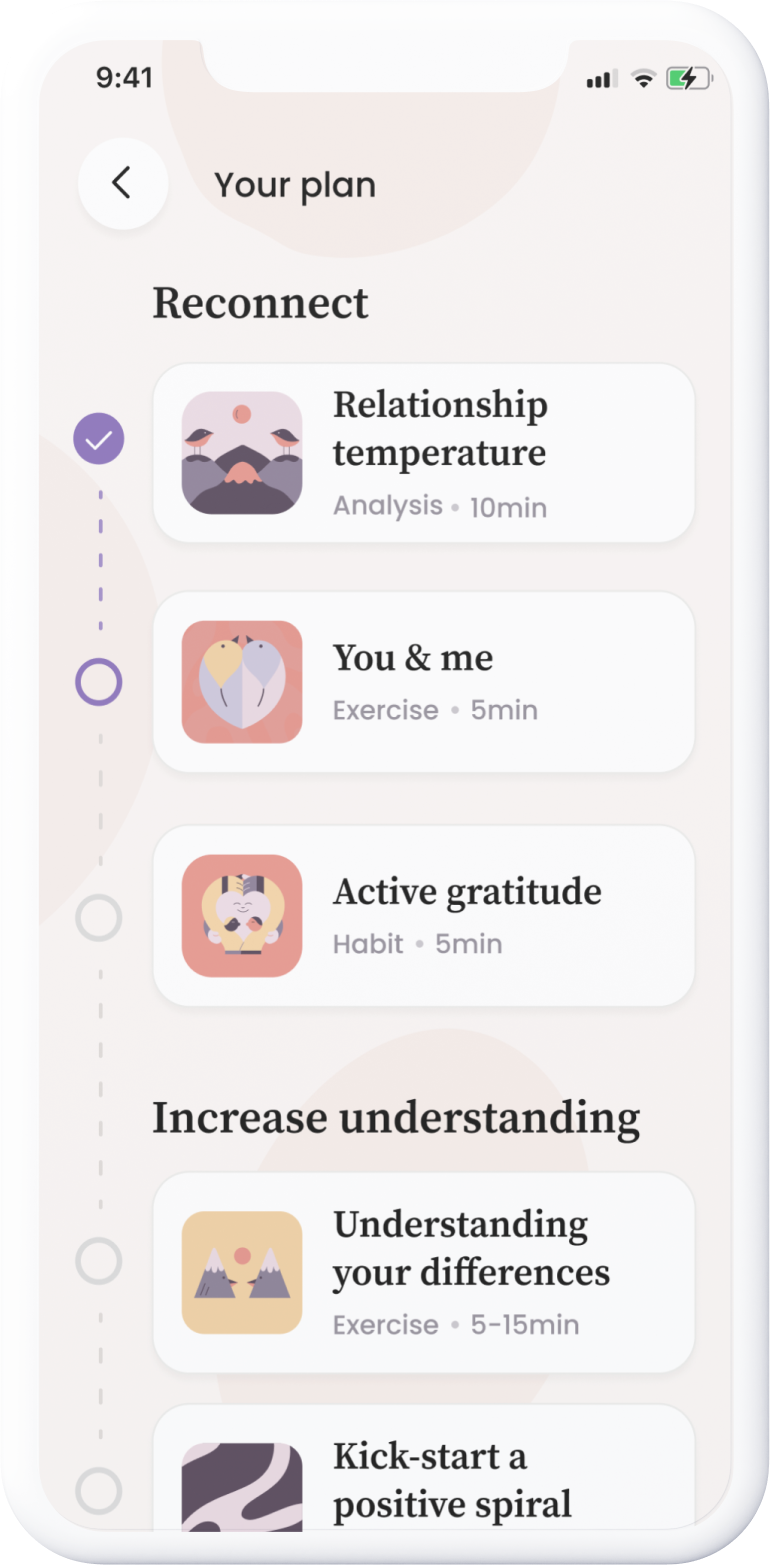

Resolving financial conflicts in relationships

1. Establishing open and honest communication

Creating a safe space for open and honest communication is vital in resolving financial conflicts. Both partners should feel comfortable expressing their thoughts, concerns, and aspirations without fear of judgment. Regular and dedicated conversations about finances can provide a platform for understanding each other's perspectives.

2. Active listening and empathy:

Practicing active listening and empathy is essential when engaging in financial discussions. Make a genuine effort to understand your partner's underlying motivations, emotions, and fears related to money. By empathizing with their viewpoint, you can foster a deeper connection and mutual respect.

3. Seeking common ground through compromise:

Seeking common ground is crucial for reconciling differing financial perspectives. Look for opportunities to compromise and find solutions that accommodate both partners' needs. This might involve creating a joint financial plan, setting shared goals, or allocating funds for personal expenses while maintaining a budget that aligns with collective aspirations.

4. Collaborating with financial professionals:

Engaging the support of a financial advisor or counselor can be invaluable in navigating financial conflicts. These professionals can provide objective guidance, mediate discussions, and help develop effective strategies to address financial disagreements constructively. Their expertise can offer fresh insights and facilitate productive conversations.

5. Enhancing financial literacy together:

Improving financial literacy as a couple can bridge the gap between divergent perspectives. Consider attending financial workshops or courses together to expand your knowledge and understanding of personal finance. This shared learning experience can foster teamwork, ignite meaningful discussions, and empower both partners to make informed decisions.

When couples encounter differences in financial perspectives, it is essential to approach these challenges with empathy, understanding, and a commitment to finding common ground. By fostering open communication, active listening, and a willingness to compromise, partners can navigate financial conflicts, strengthen their relationship, and build a future grounded in shared goals. Remember, it is through mutual respect, compassion, and a united financial vision that couples can harmonize their financial perspectives and cultivate a thriving and fulfilling partnership.